Looks like 2017 begins the same way 2016 ended, with the Bank of Canada announcing that it has maintained its target for the overnight rate at 1/2 percent. While the Bank Rate is correspondingly 3/4 of a percent, with the deposit rate holding steady at 1/4 percent as well. The Bank of Canada also released it’s January 2017 Monetary Policy Report and noted that “The Canadian economy is expected to expand by 2.1% this year and in 2018.”

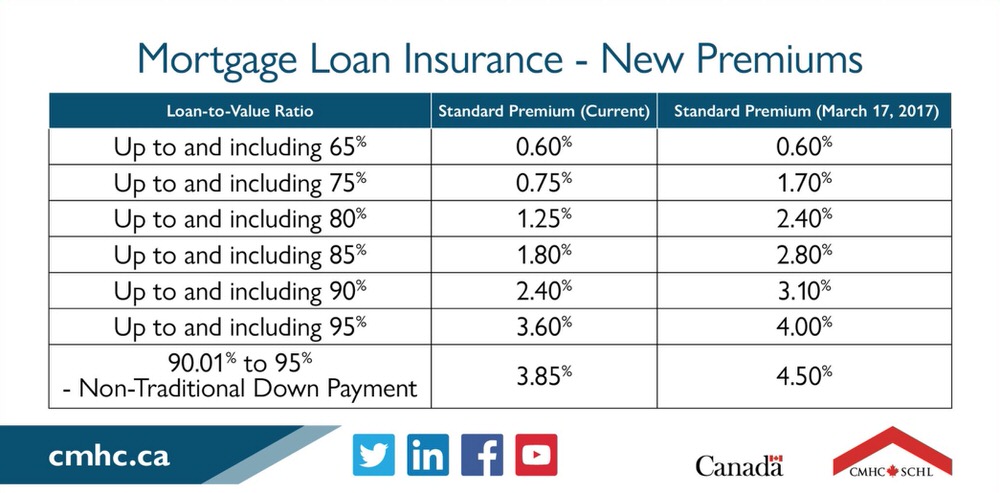

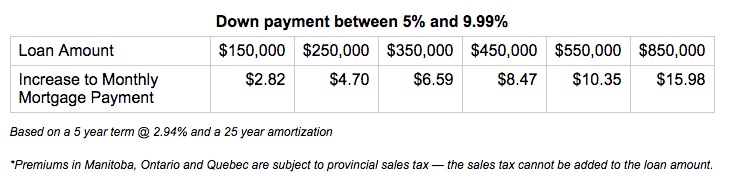

What does this mean for you? It means everything today is exactly as it was yesterday… which isn’t saying much, as yesterday (in case you missed it) had CMHC announce that they were increasing mortgage insurance premiums. Click here to have a read.

The official announcement goes on to say that:

Uncertainty about the global outlook is undiminished, particularly with respect to policies in the United States. The Bank has made initial assumptions about prospective tax policies only, resulting in a modest upward revision to its US growth outlook. Overall, the global economy is strengthening largely as expected and prices of some commodities, including oil, have risen. The rapid back-up in global bond yields, partly reflecting market anticipation of US fiscal expansion, has pulled up Canadian yields relative to the October Monetary Policy Report (MPR).

In contrast to the United States, Canada’s economy continues to operate with material excess capacity. While employment growth has remained firm, indicators still point to significant slack in the labour market. The resource sector’s adjustment to past commodity price declines appears to be largely complete, but negative wealth and income effects will persist. Meanwhile, the Canadian dollar has strengthened along with the US dollar against other currencies, exacerbating ongoing competitiveness challenges and muting the outlook for exports. Consumption is expected to remain solid, while residential investment will be tempered by previously announced changes to housing finance rules and by mortgage rates that have risen in response to higher bond yields. Federal and provincial fiscal measures are still expected to support growth in 2017.

Bearing in mind the important assumptions embedded in its forecast, the Bank projects that Canada’s real GDP will grow by 2.1 per cent in both 2017 and 2018. This implies a return to full capacity around mid-2018, in line with October’s projection.

Inflation in Canada has been lower than anticipated since October, mainly because of declines in food prices. Measures of core inflation are below 2 per cent, reflecting material excess capacity in the economy. As consumer energy prices rise and the impact of lower food prices dissipates, inflation is expected to move close to the 2 per cent target in the months ahead and remain there throughout the projection horizon while excess capacity is being absorbed.

In the context of a projection that is largely unchanged, the Bank’s Governing Council judges that the current stance of monetary policy is still appropriate and maintains the target for the overnight rate at 1/2 per cent. Governing Council will continue to assess the impact of ongoing developments, mindful of the significant uncertainties weighing on the outlook.

Here are the announcements dates set our for 2017.

- Wednesday 1 March

- Wednesday 12 April*

- Wednesday 24 May

- Wednesday 12 July*

- Wednesday 6 September

- Wednesday 25 October*

- Wednesday 6 December

*Monetary Policy Report published

All rate announcements will be made at 10:00 (ET), and the Monetary Policy Report will continue to be published concurrently with the January, April, July and October rate announcements.